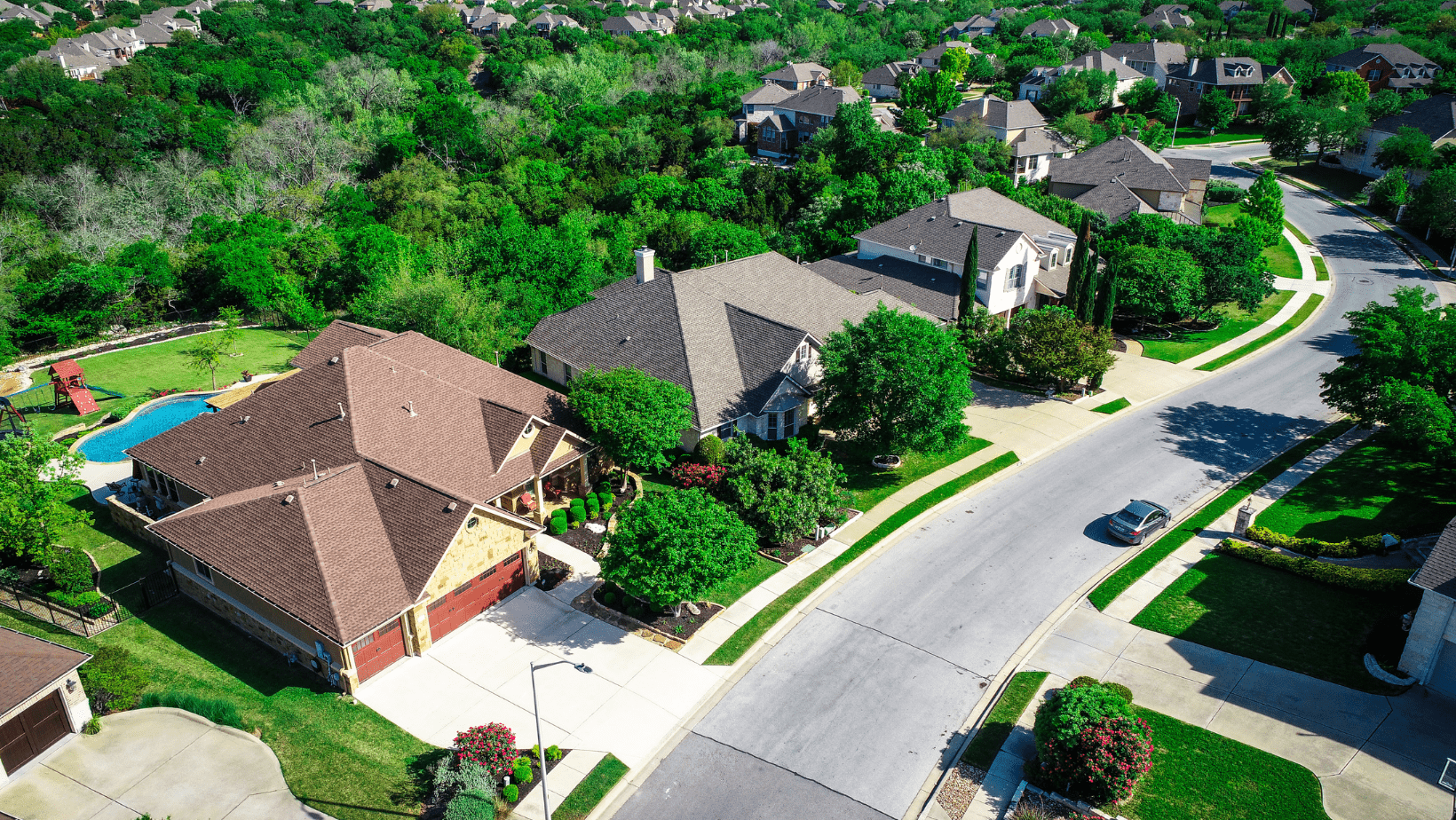

U.S. home values are rising again, but property prices in Texas have been somewhat mixed. The median price of homes sold in Texas in the third quarter of 2023 fell 1.5% compared to the same period in 2022, according to the Texas Realtors’ 2023-Q3 Quarterly Housing Report. The median sales price of Texas homes in the third quarter dipped to $340,000 from $345,000 in the same period last year. Half of the homes sold in the third quarter were in the $200,000-$399,999 price range. At the lowest and highest ends of the price distribution, 13% of homes were sold for less than $200,000, while 4% sold for $1 million or more.

As Texas is the nation’s second-largest state, its housing market is a complex one. Price trends in Texas vary by region and even by neighborhood. For instance, more Texas metro areas experienced price increases than decreases. In the Dallas metro area, prices dipped 1.2% from a year ago. In Houston, prices were off 1.1%. San Antonio prices were off 1.6%. And Austin had a decline of 7.9%. However, many smaller markets – including Corpus Christi, El Paso, Sherman, and Waco – saw year-over-year price increases.

Meanwhile, the Texas housing market continues to shift away from a strong seller market. In the third quarter of 2023, active listings, days on the market, and months of inventory all saw increases from the same period in 2022.

Texas homes spent an average of 48 days on the market in Q3 2023, 17 days longer than in the same quarter last year. Taking the number of days to close into consideration, on average it took 11 days longer to sell a property in Q3 2023 than in the same quarter last year.

With its strong economy, warm weather, and favorable affordability factors, Texas continues to attract buyers from around the country and around the world. The state added 435,800 jobs from September 2022 to September 2023 and posted one of the strongest rates of job growth in the nation, according to the U.S. Labor Department.

Here are a few of LendSure’s programs that can help you build your business in the Lone Star State:

- The high DTI program. Median home prices in Austin and Dallas-Fort Worth are north of $500,000. At those price levels, borrowers are looking for flexibility in terms of amortization schedules and qualifying parameters. Enter LendSure’s 55% DTI 40-year IO product. This innovative loan program allows borrowers to show a debt-to-income ratio of up to 55%. What’s more, the 40-year amortization schedule lowers monthly payments, and the interest-only feature reduces payments even farther.

- DSCR loans for investment properties. LendSure’s debt-service coverage ratio (DSCR) program is designed to attract property investors. LendSure looks at market rents to qualify the property (instead of considering only currently rented units to support the loan amount), creating an easier path to approval. In other words, not all units need to be rented.LendSure underwrites the investment property based on both current and future rent. For an explanation of our DSCR loans, see this short video.

LendSure has expanded its DSCR program beyond the typical one to four units – we make DSCR loans on properties with up to eight units.

- Full-doc investment loans. In another example of LendSure’s offerings for investors, we have a program that uses a unique way of calculating rent that will benefit the investor and qualify for more loans. With LendSure’s rental income calculation, negative cash flows offset the total income, resulting in lower DTIs and better rates. Here’s a video on how it works.

- Non-warrantable condo loans. LendSure prides itself on being a lender who will use a common-sense approach to get your borrower funded and help the client close on their non-warrantable condo on time

The latest condo guidelines from Fannie Mae and Freddie Mac, introduced in early 2022 to address the structural integrity of condo buildings, caused upheaval in the condo market. If you have a borrower whose conforming deal has been rejected or stalled because of the agencies’ onerous rules, we can help. LendSure’s common-sense rules allow for approvals of non-warrantable condos that the agencies reject, including condotels.

The LendSure Way

It’s simple. We make loans that make sense. We’re not in-the-box lenders. Of course, there are numbers ratios, and data to consider, but we know that behind every file, there’s an individual with a unique circumstance seeking a loan. We work hard to offer our common-sense take on lending to borrowers seeking funding for the home of their dreams, another addition to their investment property portfolio, or refinancing of a currently-owned property.

Are you ready to benefit from a commonsense approach to lending? Contact us today to learn more about non-QM loans and how partnering with LendSure Mortgage Corp. can help grow your bottom line.