Asset Depletion / Asset Qualifier Program

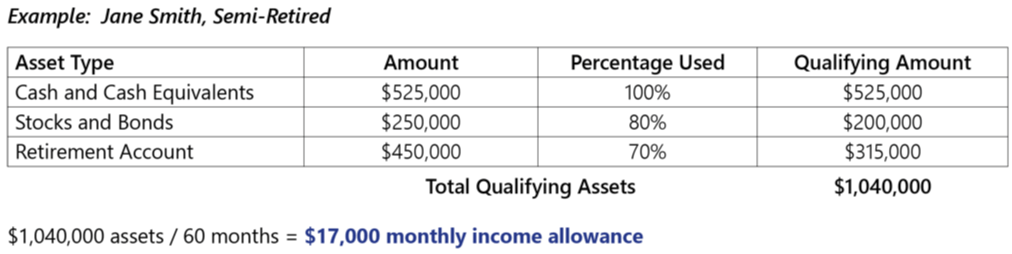

Borrowers with great credit, but no steady monthly income, may be able to use their assets to qualify for a mortgage. Compared to asset depletion, LendSure’s Asset Qualifier program essentially doubles the qualifying monthly income, since the draw period is only 5 years (qualifying assets / 60 months).

- Primary Residence:

– Up to 90% LTV for Purchase and 80% LTV for R/T Refinances

– Up to 70% LTV for Cash-Out Refinances

- Second Homes and Investment Properties:

– Up to 80% LTV for Purchase and 75% LTV for R/T Refinances

– Up to 70% LTV for Cash-Out Refinances

- Borrower must have no mortgage delinquency in the last 3 years

Our knowledgeable Account Executives are experts in Non-QM loans and will help you find solutions for your borrowers so you can close more deals each month. Contact your LendSure Account Executive to talk through your borrower’s loan scenario.