Mortgage rates keep rising, a trend that shows no signs of reversing after the Federal Reserve in September enacted its third consecutive rate hike of three-quarters of a point.

Mortgage rates have soared past 6 percent, and homebuyers are being hit by the one-two punch of still-high home prices and mortgage rates that have doubled over the past year. Rate-sensitive borrowers always have had the option of paying discount points to buy down the mortgage rate. But that tactic usually carries a downside – the borrower has to pay the points up front.

To help you offer more attractive borrowing options to your clients, LendSure has a solution in the form of our Rate Cutter program. We offer borrowers the flexibility to buy down their rate and finance the points. It’s a feature that gives homebuyers the best of both worlds. They get a lower rate without coming up with more money at closing.

Here are the features of LendSure’s Financed Rate Buy Down:

- Lender and broker points can be financed into the loan (up to 2%).

- Finance points do not raise the LTV pricing bucket.

- Borrowers can take up to 87% LTV when financing points (at the 85% pricing tier).

- The borrower does NOT have to bring additional cash to close.

- The lower rate significantly reduces the borrowers’ monthly payment.

Here’s an example of how the program might work for a typical borrower. Say your client borrows $425,000 at 6 percent, for a monthly payment on a 30-year loan of $2,548. Through LendSure’s Financed Rate Buy Down, the $8,500 in discount points would be added onto the balance, and the rate would fall to 5 percent, for a monthly payment of $2,327.

In this scenario, the borrower saves $221 a month, or $2,652 a year, with no additional money out of pocket. For buyers challenged by today’s unfavorable affordability, this is a great deal.

Other lenders would let the borrower buy down the rate, but the $8,500 buy-down fee would be due at closing.

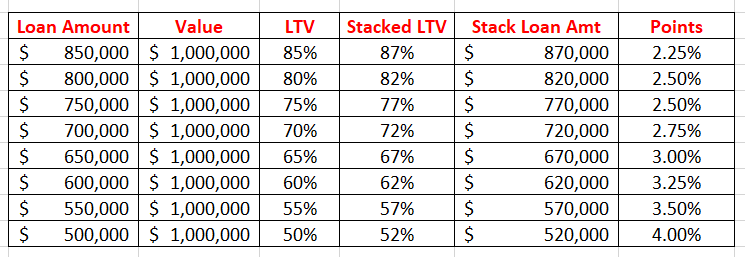

See matrix below for an example of different loan values combined with different LTVs and point structures.

**Based on the original LTV, the available 2% additional LTV will equate to different available points that can be utilized.**

At LendSure, we understand that these are tough times for borrowers and for loan officers alike. Contact one of our skilled account executives to learn more about LendSure’s Financed Rate Buy Down, and how this unique program can help you say yes to deals.