Loans up to $3,000,000 & Rates Starting at 3.125%

LendSure offers expansive Jumbo loan options so you can close larger loans with a lot less hassle.

- Rates starting at 3.125%

- Pricing is LTV and FICO driven – LTV’s less than 70% – rates are in the low to mid 3’s

- No adders for self-employed borrowers

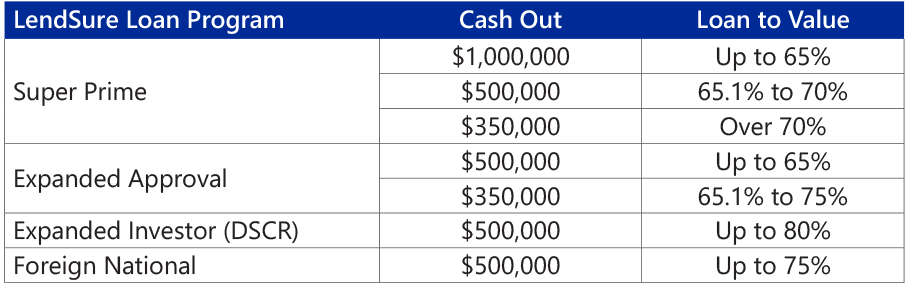

- Cash out – up to $2.5MM

- Non-warrantable condos will be considered.

- Condo-tels will be considered.

- Unlimited properties on the borrower’s REO schedule are okay.

- Interest Only (10 year – 40 year available)

- RSU income is okay – (we do not have a one-size fits all approach to the use of RSU income)

- 6–12-month reserve requirement – not 18

- Crypto-currency will be considered on a cases-by-case basis.

- Major credit events seasoning – 4 years

- DTI’s to 45% – no adder, can get to 50% w/adder

- Business Assets CAN be used for reserves.

- If Full Package – close your loan in 10 day. Yes, we will use the appraisal you have in hand!

- Bank statement income okay – 12 and 24 month programs

- Aggressive Asset Depletion Program as well

- Use cash out for depletion income

- Assets divided by 60 months