FOR IMMEDIATE RELEASE

Innovative Loan Programs Expand Mortgage Brokers’ Purchase and Refinance Loan Business

June 23, 2020, San Diego, CA – LendSure Mortgage Corp., a leading Non-QM wholesale lender, announced the continuing expansion of its program offerings since their return to lending in early May, 2020. LendSure’s robust offering of Non-QM products are designed to meet the needs of today’s borrowers, including the self-employed, business owners, property investors, and foreign nationals.

Because of the Covid19’s unprecedented and unexpected impact on the economy, the company was unable to evaluate credit risk, hence paused funding loans for several weeks. LendSure’s operations and sales staff are actively pre-qualifying, underwriting and funding loans.

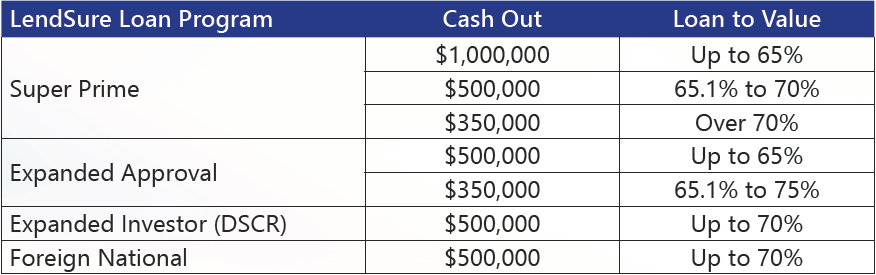

LendSure is offering a robust suite of Non-QM loan programs, including:

- Bank Statement Loans for self-employed borrowers

- Condo-tel and Non-Warrantable Condos Loans

- Investment Property Loans with a range of income documentation options, Including Full Documentation, Bank Statement and Property Investor Cash Flow Loans (DSCR)

- Foreign National Loans

- Asset Depletion Loans

“Since we started taking applications again, the demand for Non-QM loans has been stronger than we initially anticipated” said Todd Harris, National Sales Director for LendSure Mortgage Corp. “With the tightening of the conforming loans, loan officers and real estate agents are pleasantly surprised to see all the options available to borrowers looking to buy their new dream homes”.

LendSure is providing outreach to the lending community about today’s emerging opportunities by launching a webinar series on Non-QM for Today’s Borrowers. The next webinar will be on Investment Property Cash Flow (DSCR) Loans and will be held on Wednesday, June 24th at 1:00 pm Eastern. Mortgage professionals can sign up via the webinar’s registration page. LendSure will continue the bi-weekly series with future topics including, Foreign National Lending and Financing for Condo-Tels and Non-Warrantable condos. Mortgage professionals can access previous webinars via the company’s website.

About LendSure Mortgage Corp.

Headquartered in San Diego, California, LendSure Mortgage Corp. was founded in 2015 to help mortgage professionals better serve their clientele by offering a wider range of programs to meet their needs. LendSure is a wholesale lender that offers a comprehensive range of Non-QM loan programs for borrowers that don’t fit conforming guidelines, including Self-Employed borrowers, business owners, property investors, and foreign national borrowers.

Media Contact:

Rose Waldie, LendSure Mortgage Corp

(858) 223-0857

[email protected]

www.lendsure.com

San Diego, Calif – October 1, 2018–LendSure Mortgage Corp is pleased to announce the appointment of John Colitz as its new Regional Sales Manager supporting business development in the Northeast and Mid-Atlantic States. Colitz is a veteran on the mortgage industry with over 30 years of experience. He will report to Todd Harris, National Sales Director.

San Diego, Calif – October 1, 2018–LendSure Mortgage Corp is pleased to announce the appointment of John Colitz as its new Regional Sales Manager supporting business development in the Northeast and Mid-Atlantic States. Colitz is a veteran on the mortgage industry with over 30 years of experience. He will report to Todd Harris, National Sales Director.