The fix-and-flip market presents a unique opportunity for brokers to connect with real estate investors—even those making their very first flip. While many traditional lenders require extensive track records, specialized Non-QM programs now accommodate investors with zero previous experience, creating an accessible entry point into real estate investing that savvy brokers can leverage to build long-term client relationships.

Fix-and-flippers see potential where others see only decay—and LendSure sees opportunity where traditional lenders see only risk. First-time flippers stand at the threshold of their first investment, and your role as their broker is to connect them with financing built specifically for borrowers with vision but no track record yet.

Jumpstart 2025 with Fix and Flip & Ground-Up Construction Financing

What Are Fix and Flip Loans?

Our Fix and Flip loans are short-term financing solutions designed specifically for real estate investors who purchase distressed properties, renovate them, and sell for profit. These loans differ fundamentally from traditional mortgage products because they focus on the property’s potential value rather than the borrower’s conventional income qualifications.

We structure these loans as 12-month interest-only products with no prepayment penalties, allowing investors maximum flexibility to complete renovations and exit the loan when market timing is optimal. The financing can extend beyond traditional flipping to support “fix and hold” strategies (commonly known as the BRRR method: Buy, Rehab, Rent, Refinance), giving your clients multiple pathways to building real estate portfolios.

Understanding First-Time Flipper Financing

Who Qualifies as a First-Time Flipper?

First-time flippers include anyone who has never completed a property renovation and resale transaction. This encompasses:

- Career changers entering real estate investing from other industries

- Rental property owners expanding into value-add investments

- Real estate agents transitioning from sales to investing

- High-income professionals seeking alternative investment vehicles

- Aspiring entrepreneurs building investment businesses from scratch

They come to you with dreams in their pockets and spreadsheets on their phones, having watched a hundred renovation shows and walked past a hundred abandoned houses, finally ready to cross over from spectator to participant.

Zero-Experience Approval: How It Works

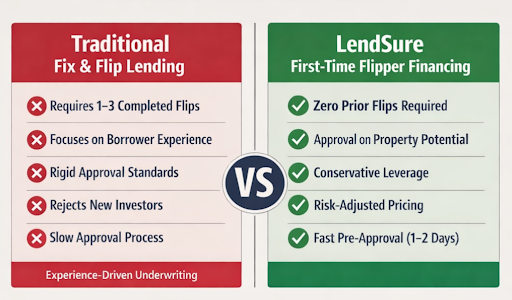

Traditional lenders typically require proof of 1-3 completed flips before extending financing. LendSure’s first-time flipper programs eliminate this barrier through adjusted risk pricing and conservative leverage ratios rather than experience requirements.

For investors with zero experience, we typically offer:

- Loan-to-Cost (LTC) ratios up to 75%: This means financing covers 75% of the purchase price plus renovation costs, requiring the investor to bring 25% to the transaction

- Risk-adjusted pricing: Interest rates range from 10% to 12.5% depending on the project’s complexity and the investor’s financial strength

- No income documentation: We don’t verify employment, review tax returns, or calculate debt-to-income ratios—the property’s potential determines approval

As investors gain experience and complete successful projects, we can increase leverage up to 85% LTC for subsequent deals, creating a progression that rewards performance and builds broker-client relationships across multiple transactions.

Documentation Requirements: The No-Doc Advantage

One of the most compelling aspects of our first-time fix and flip financing is the streamlined documentation process. Unlike conventional mortgages that can require weeks of income verification and extensive paperwork, we approve these loans based primarily on:

Required Documentation

Entity Formation: Borrowers must close in an LLC or S-Corporation rather than personal names. This protects investors from personal liability and creates proper business structure from their first deal. We can guide your clients through entity formation if they haven’t already established one.

Project Financials: A clear breakdown of purchase price, estimated renovation costs, and projected after-repair value (ARV). These numbers form the basis of our underwriting analysis—the arithmetic that transforms aspiration into action.

Property Information: Address, property type (1-4 units, condos, or modular homes—manufactured homes excluded), and current condition assessment.

Proof of Funds: Documentation showing the investor can cover the required down payment and reserves. We accept bank statements, investment account statements, or other liquid asset verification.

What We Don’t Require

- Federal tax returns

- W-2s or pay stubs

- Employment verification

- Credit score (in most cases)

- Debt-to-income calculations

- TRID compliance disclosures

This no-doc approach means you can prequalify clients in 1-2 business days with a formal term sheet, positioning you to help investors move quickly on time-sensitive opportunities—a critical advantage in competitive markets where properties receive multiple offers.

Loan Structure and Terms

Financial Framework

Loan Amounts: We finance based on total project cost, including both acquisition and renovation expenses. For example, if a property costs $200,000 to purchase and requires $50,000 in renovations (total project cost of $250,000), a first-time flipper at 75% LTC would receive $187,500 in financing.

Interest-Only Payments: Monthly payments cover interest only, not principal, keeping carrying costs lower during the renovation period when the property generates no income. This structure improves project cash flow and reduces the capital your clients need to maintain during construction.

12-Month Term: The standard balloon payment structure gives investors a full year to complete renovations and sell the property. For projects running longer than anticipated, extension options may be available depending on project progress and market conditions.

No Prepayment Penalties: If your client completes renovations ahead of schedule and sells quickly, they pay zero penalties for early payoff. This also means no Early Payoff (EPO) penalties affecting your compensation, ensuring you’re never penalized for helping clients succeed efficiently.

Draw Process for Renovation Funds

Rather than releasing all renovation funds at closing, we use a draw system that protects both the investor and the lender. Here’s how it works:

- At Closing: The investor receives funds to purchase the property

- During Renovation: As work is completed, the investor requests draws for reimbursement

- Inspection and Release: We inspect completed work (~$300 for initial inspection, ~$200 for subsequent draws) and release funds once improvements are verified

This reimbursement structure means investors need sufficient reserves to pay contractors before receiving draws. For a first-time flipper, this typically requires more liquid capital than experienced investors who may have established relationships with contractors willing to wait for payment.

For example, if the renovation budget includes $15,000 for foundation work, the investor pays the contractor, we inspect the completed foundation, and then release the $15,000 draw. This protects everyone by ensuring funds are used appropriately and work meets quality standards.

Eligible Properties and Restrictions

Understanding property eligibility helps you identify deals that qualify before your clients waste time on properties we can’t finance.

Property Types We Finance

- Single-family residences (1 unit)

- Duplexes, triplexes, and fourplexes (2-4 units)

- Condominiums (subject to project review)

- Modular homes (factory-built but placed on permanent foundations)

Properties We Don’t Finance

Manufactured Homes: Mobile homes or properties not on permanent foundations don’t qualify, regardless of renovation potential.

Owner-Occupied Projects: These loans are exclusively for investment properties. Borrowers cannot live in the property during renovation or use it as a primary residence after completion.

5+ Unit Properties: Our fix and flip program caps at fourplexes. Larger multifamily properties require different commercial lending products.

Assignment of Contracts: We generally don’t finance wholesaling strategies where the borrower assigns the purchase contract to another buyer. However, if an investor has significant equity in the deal (30%+ down payment), we can discuss exceptions.

Beyond the First Flip: Building Long-Term Relationships

The real opportunity in first-time fix and flip lending isn’t just the initial transaction—it’s the relationship trajectory. Investors who successfully complete their first flip typically pursue multiple projects, creating a recurring revenue stream for brokers who guide them effectively.

The Investor Progression Path

- First Flip (75% LTC, higher rates): Investor proves concept and develops systems

- Flips 2-5 (80% LTC, improved pricing): Investor refines process and builds experience

- Established Investor (85% LTC, best rates): Multiple simultaneous projects with proven track record

- Transition to Long-Term Holds: Refinance completed projects into DSCR loans for rental portfolio

This progression means a first-time flipper you help today could generate 5-10+ loan transactions over the next 2-3 years as they scale their business. Positioning yourself as their financing partner through education and reliable execution creates tremendous lifetime value from a single initial relationship.

You plant the seed with that first nervous borrower, and if you tend it right, you’ll harvest transactions season after season, watching them grow from tentative beginners into confident operators who call you first every time.

Competitive Positioning: Why Choose Specialized Fix and Flip Financing?

Your clients likely have alternative funding sources. Here’s how to position the value of working with specialized Non-QM lenders rather than alternatives:

vs. Hard Money Lenders

Traditional hard money often charges 12-15%+ with significant origination fees and points. Our competitive pricing (10-12.5%) and no prepayment penalties deliver better total cost while maintaining the same no-doc convenience.

vs. Private Money Lenders

While private lenders (friends, family, investment groups) may offer flexible terms, they often lack the structure and documentation that protects the borrower legally. Institutional lending provides clear contracts, proper draw processes, and professional oversight that prevents disputes.

vs. Cash Purchases

Investors using only cash limit their purchasing power dramatically. A client with $200,000 in cash can buy one property outright or use that same capital to control 2-3 properties with leverage, potentially tripling their profit on successful projects. Fix and flip loans multiply investment capacity.

vs. Conventional Renovation Loans

Products like FHA 203(k) or Fannie Mae HomeStyle renovation loans require owner occupancy, extensive income documentation, and lengthy approval processes. They’re completely inappropriate for investment property flips, making specialized fix and flip financing the only viable path.

Common First-Timer Pitfalls (And How to Help Clients Avoid Them)

Guiding first-time flippers around common mistakes not only protects your clients but establishes you as a trusted advisor who adds value beyond loan placement.

Underestimating Renovation Costs

According to data from HomeAdvisor, the average home renovation runs 20% over initial estimates. Encourage your clients to:

- Get multiple contractor bids before finalizing budgets

- Add 20% contingency for unexpected issues

- Itemize costs in detail rather than using rough estimates

- Account for carrying costs (interest, utilities, insurance, HOA fees)

Overestimating After-Repair Value

Aggressive ARV projections based on aspirational comparable sales rather than realistic market conditions create underwater situations. Help your clients:

- Use conservative comparable sales from the past 6 months

- Account for market conditions and seasonal demand

- Get professional appraisals rather than relying on online estimates

- Consider days-on-market trends, not just final sale prices

The numbers on paper can seduce a beginner into wild optimism, but you’ve seen enough deals to know that houses sell for what buyers will pay, not what spreadsheets promise.

Poor Timeline Planning

Renovation timelines that don’t account for permitting delays, contractor availability, or seasonal weather patterns create pressure as the 12-month term approaches. Advise clients to:

- Build 2-3 month buffers into their timelines

- Start permit applications immediately after closing

- Establish contractor relationships before purchasing properties

- Plan major exterior work for favorable weather seasons

Inadequate Reserve Funds

Remember, the draw process is reimbursement-based, meaning investors pay contractors before receiving funds. Clients need sufficient reserves beyond their down payment to cover contractor payments while awaiting draws. A good rule of thumb is maintaining liquid reserves equal to 25-30% of total renovation costs.

Ready to Help First-Time Flippers Build Their Investment Future?

Our streamlined approval process means you can prequalify clients in 1-2 business days with a formal term sheet—fast enough to help them compete in tight markets where investment properties receive multiple offers. With no income verification, no tax returns, and no employment documentation required, you can confidently bring us deals that traditional lenders would reject outright.

Submit a scenario today through our broker portal and experience the difference that specialized Non-QM lending makes. Our team understands investment property financing inside and out, and we’re here to support you with competitive pricing, transparent terms, and the expertise your clients need to succeed from their first flip forward.

Questions about a specific project? Need current rate sheets or program guidelines? Contact our broker support team directly. We’re here to make your first-time flipper financing smooth, compliant, and profitable for both you and your clients.

Frequently Asked Questions

Can first-time flippers really get approved with zero experience?

Yes. Unlike traditional lenders requiring proven track records, we evaluate first-time flippers based on the project’s merit, their financial capacity to execute the plan, and appropriate risk pricing. Thousands of investors complete their first successful flips through specialized financing that doesn’t demand prior experience.

What credit score do first-time flippers need?

Fix and flip loans focus primarily on the property’s potential rather than personal credit scores. While we do review credit as one factor among many, there’s no strict minimum score requirement. Stronger credit may improve pricing, but challenged credit doesn’t automatically disqualify borrowers with strong projects and adequate capital.

How much cash does a first-time flipper need to bring?

At 75% LTC, borrowers typically need 25% of total project cost (purchase plus renovations) plus reserves to cover contractor payments during the draw process. For a $250,000 total project cost, expect $62,500 down payment plus $20,000-30,000 in working capital reserves.

What happens if the renovation isn’t complete at 12 months?

We evaluate extension requests on a case-by-case basis. If the project shows substantial progress, market conditions remain favorable, and the investor has maintained communication throughout, extensions may be available. However, investors should plan realistically to complete within the initial term.

Can first-time flippers finance multiple properties simultaneously?

Typically we limit first-time investors to one project initially to ensure they develop effective systems before scaling. After successful completion of their first flip, we can discuss financing additional properties, with limits typically around five simultaneous projects for relatively new investors.

Do these loans require flood insurance or other special coverages?

Yes. Standard property insurance, flood insurance (if applicable), and builder’s risk insurance during major renovations are typically required. We can connect your clients with insurance providers experienced in investment property coverage.

What’s the difference between fix-and-flip and fix-and-hold financing?

Fix-and-flip assumes the investor will sell the property after renovation. Fix-and-hold (BRRR method) means the investor plans to rent the property long-term after renovation and eventually refinance into a permanent loan. Our 12-month fix and flip loan accommodates both strategies—the investor simply determines their exit path (sale or refinance into DSCR loan) based on market conditions and personal goals.

Can a first-time flipper use an FHA loan to buy a property to flip?

No. FHA loans require owner occupancy, meaning the borrower must live in the property as their primary residence. Fix and flip is an investment strategy requiring investment property financing. Attempting to use FHA financing for a flip would constitute mortgage fraud.

How do I explain the higher interest rate to clients used to conventional mortgages?

Frame it correctly: “This isn’t a 30-year mortgage—it’s a 12-month business loan that lets you multiply your capital. If you buy a property for $200,000, put in $50,000 of renovations, and sell for $325,000, you make $75,000 gross profit. The $15,000-20,000 in interest is simply the cost of making that $75,000, and you’re only paying it for one year, not thirty. That’s a business expense that enables significant profit, not a long-term housing cost.”