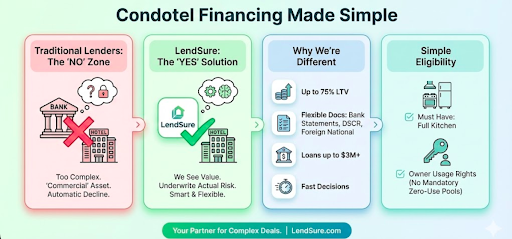

When it comes to financing condotels (hybrid properties that blend condo ownership with hotel-style amenities) most traditional lenders won’t even consider the deal. The unique structure of these investments creates underwriting complexities that fall outside conventional mortgage guidelines.

We approach condo-hotel financing with the understanding that resort markets operate by different rhythms, and that sensible underwriting requires more than a one-size-fits-all checklist. This is how we help brokers place loans where others cannot, and help you build relationships that last beyond a single transaction.

All About Non Warrantable Condos and Condotels

If you have a client looking at a condo-hotel in Miami, Park City, or any other resort town shaped by season and tourism, it is worth pausing before writing the deal off. These properties are not traditional condominiums, but they are financeable when approached with experience and care. Submit a scenario or explore our condotel loan program to see how we structure condotel deals differently.

What Is a Condotel Loan, and Why Is It So Hard to Finance?

A condotel mortgage is a specialized financing product we use to purchase or refinance a unit in a property that operates as both a condominium and a hotel. Owners typically hold title to a specific unit, can use it for personal stays, and may opt into a rental program that generates income when they’re not there.

On paper, it sounds simple: a condo with hotel perks. In underwriting, it is rarely that tidy.

The same features that make condotels attractive, hotel management, short-term rental income, brand operations, and occupancy-style restrictions, also create the very conditions that disqualify most of these projects from conventional financing.

Traditional lenders usually rely on agency guidelines—the playbooks shaped by Fannie Mae and Freddie Mac—and those guidelines tend to treat condotels less like residential condos and more like commercial hospitality assets. Projects with things like mandatory rental pool participation, hotel-style operations that dominate the property, or restrictions that meaningfully limit owner occupancy rights commonly fail agency eligibility tests.

That agency gap is exactly where the condotel market lives. And it’s why investors typically need lenders willing to underwrite beyond checkbox conformity—non-QM lenders like us—who can evaluate the actual risk of the borrower, the project, and the rental structure rather than defaulting to an automatic decline.

LendSure Mortgage Corp.’s Approach to Condotel Financing

We’ve built our condotel loan program specifically for investors and second-home buyers who encounter resistance from traditional lenders. Our underwriting approach recognizes that condotel investments can represent sound financial decisions even when they don’t fit conventional mortgage boxes.

Flexible Leverage Options

Our condotel financing accommodates various transaction types with competitive loan-to-value ratios:

- Purchase financing up to 75% LTV (with a 740+ credit score)

- Rate-and-term refinancing up to 75% LTV (740+ score)

- Cash-out refinancing up to 65% LTV

Multiple Documentation Pathways

One of our key advantages lies in accepting diverse income documentation approaches. We recognize that condotel investors often have complex financial profiles—business owners with significant write-offs, foreign nationals without U.S. tax history, or portfolio investors whose income doesn’t reflect their true financial capacity.

Our program accepts full documentation for borrowers who prefer traditional verification, but we also offer bank statement programs, DSCR (Debt Service Coverage Ratio) qualification based on property cash flow, asset depletion methods for high-net-worth individuals, and specialized foreign national programs.

Investment and Second Home Focus

Our condotel loans serve investment properties and second homes exclusively—we don’t finance condotels as primary residences. This focus aligns with how these properties actually function in the market. Most condotels come with deed restrictions prohibiting full-time residence anyway, so this limitation rarely creates issues for legitimate buyers.

Property Eligibility Standards

Units must include full kitchens—not just mini-fridges and microwaves, but actual cooking facilities with ranges, ovens, and full-size refrigerators. While our guidelines technically state a 600-square-foot minimum, we’ve approved smaller units (down to around 500 square feet) when they include proper kitchens and the overall project shows strong fundamentals.

We restrict financing for properties with mandatory rental pooling that completely eliminates owner usage rights. We also avoid properties with “hotel” in the actual unit name or properties structured as common interest apartments rather than individually deeded units.

Key Program Features

Our condotel mortgage program provides loan amounts up to approximately $3 million, depending on the specific property and borrower profile. Credit score requirements start at 680, though better rates and terms become available at higher score tiers, particularly at 740+.

In particularly strong scenarios, exceptions may be considered on both loan size and loan-to-value. For example, imagine a Park City condotel purchase involving a foreign national borrower seeking a $1.6 million loan at 65% LTV. Under standard guidelines, this request would exceed both a typical foreign national loan cap (around $1 million) and the usual LTV limit for larger loan amounts.

In a case like this, a lender could justify dual exceptions if the overall borrower profile, liquidity, and property fundamentals supported the risk. Strong credit, significant reserves, a high-quality project, and demonstrated rental performance might collectively warrant flexibility beyond standard parameters.

What Mortgage Brokers Should Know

The condotel financing space represents genuine opportunity for brokers working with investment-focused clients. Traditional banks and credit unions almost universally decline these deals, which means brokers who understand condotel lending can capture business that would otherwise go to cash buyers or remain unfunded.

Real estate investors seeking vacation market exposure without full-time rental management responsibilities find condotels attractive—the hotel operation handles marketing, maintenance, and guest services while the owner maintains equity and usage rights.

Foreign nationals looking to establish U.S. real estate holdings often gravitate toward condotels in high-tourism areas. We see significant condotel demand from Latin American buyers in Florida, European and Asian buyers in the Northeast and California, and international investors in major ski markets. Our foreign national program requires no U.S. tax returns, no Social Security number, and no domestic credit history—we can qualify buyers using bank statements, CPA letters, employer letters, or DSCR analysis.

Self-employed borrowers and business owners whose tax returns understate true income can access condotel financing through bank statement or DSCR documentation. Our floating expense factor approach on bank statement loans means we analyze actual business expenses rather than applying arbitrary 50% or 70% expense ratios. A consultant working from home might have only 15% in true business expenses—recognizing that reality can make deals work that wouldn’t under standardized expense assumptions.

High-net-worth individuals seeking passive real estate investments appreciate condotel structures that eliminate landlord responsibilities. Our asset depletion programs use a 60-month draw period that effectively doubles qualifying income compared to traditional asset qualifier programs.

Working with clients eyeing that beachfront condotel or ski resort property? We’d love to walk you through our program details and show you how our flexible underwriting can help close deals other lenders turn away. Our wholesale team understands the nuances of condotel financing and can provide scenario-specific guidance that helps you position these opportunities with confidence. Explore our condotel loan program or reach out directly—we’re here to be your partner on the complex deals that make your business thrive.

The Non-QM Advantage

The fundamental reason traditional lenders avoid condotels isn’t that these properties represent poor investments—it’s that they don’t fit standardized underwriting models designed for agency conforming loans. Non-QM lenders like us fill this gap by applying manual underwriting expertise to evaluate deals based on actual risk rather than agency checkbox compliance.

We examine the specific condotel project’s financial health, rental history, management quality, and market positioning. We evaluate borrower creditworthiness through multiple lenses beyond just tax returns and credit scores. We structure loan terms that match the investment’s cash flow characteristics rather than forcing every deal into identical 30-year fixed templates.

Documentation & Process

Condotel loans require more than a standard condo file. In addition to credit and property basics, we review project-level details to understand how the property actually operates.

For Project Documentation we require:

- Legal structure of the condotel

- Rental program terms (mandatory vs. voluntary)

- Management agreements

- Historical financial performance and occupancy

For borrowers using alternative documentation methods, the specific requirements vary by program. Bank statement borrowers provide 12 or 24 months of business and/or personal account statements plus our self-employed questionnaire—a simple eight-to-ten question form covering basic business information like current rent, number of employees, payroll costs, and cost of goods sold if applicable.

DSCR qualification requires detailed property financial analysis including rental income documentation and operating expense verification. Asset qualifier applicants document liquid asset holdings through current account statements.

Turn Times

- Initial underwriting decisions in 3–6 business days

- ~3 days for complete, straightforward files

- Up to 6 days for complex scenarios or month-end volume

- Fast-track fallout deals have closed in as little as 15 days with complete documentation

Questions about what documentation your client needs, or how long the process might take? Our team can provide clear answers based on the specific scenario you’re working with. We know condotel deals often move on tighter timelines than traditional purchases, and we prioritize communication so you can keep your clients informed throughout the process. Learn more about our condotel financing approach or connect with our wholesale team to discuss your current pipeline.

Frequently Asked Questions

Can first-time investors qualify for condotel financing?

Yes. While we always evaluate borrower experience as part of our overall risk assessment, first-time real estate investors can absolutely qualify for condotel financing. We require that they own their primary residence, but they don’t need previous investment property experience. DSCR qualification works particularly well for newer investors since the property’s cash flow drives approval rather than personal investment history.

Do you allow VRBO or Airbnb rental income for qualification?

Yes, if the condotel already participates in vacation rental programs through platforms like VRBO or Airbnb, we can use that documented income for qualification. We’ll review the rental history directly from the platform, typically averaging income over 12 or 24 months to determine sustainable cash flow.

What’s the maximum loan amount for condotel financing?

We provide condotel loans up to approximately $3 million, with the exact amount depending on property type, location, borrower profile, and documentation method. We’ve made exceptions above this threshold for particularly strong scenarios—a recent Park City condotel involved a $1.6 million loan, exceeding our standard foreign national limits.

How long does condotel financing take?

Processing timelines vary based on file completeness and transaction complexity. Our current turn times run three to six business days for initial underwriting decisions. For complete packages on straightforward deals, we’re typically closer to three days. Month-end volume or complex scenarios may extend to six days. We’ve closed condotel loans in as little as 15 days for brokers providing complete documentation upfront.

What makes a property ineligible for condotel financing?

We won’t finance timeshares, properties with “hotel” in the actual unit name, common interest apartments, or units with mandatory rental pooling that completely eliminates owner usage rights. Properties must have full kitchens (not just mini-fridges and microwaves) and function as individually deeded condominium units with optional rental program participation.

Can foreign nationals get condotel financing?

Yes, and this represents a significant portion of our condotel business. Our foreign national program requires no U.S. tax returns, no Social Security number, and no domestic credit history. We can qualify international buyers using bank statements from their home country, CPA letters, employer letters, or DSCR analysis based on the property’s rental income potential.

Do you review HOA litigation for condotel projects?

Yes, we review any pending litigation as part of our project analysis. However, litigation doesn’t automatically disqualify a property. We’ve approved numerous condotels with pending slip-and-fall cases or other litigation that doesn’t involve the structure itself or threaten the project’s financial viability. Each situation receives individual evaluation.

Can self-employed borrowers use bank statements for condotel financing?

Absolutely. Our bank statement program works particularly well for self-employed condotel buyers. We use a floating expense factor methodology rather than applying arbitrary percentages. You’ll provide 12 or 24 months of bank statements plus complete our simple self-employed questionnaire covering basic business information. We calculate actual expenses based on your responses—so a consultant with minimal overhead might have only 15% in business expenses rather than the 50% many lenders automatically apply.

Final Perspective

Condotel mortgage lending exists because traditional financing channels systematically exclude a category of property that can represent sound investment. The gap between agency restrictions and investment reality creates opportunity for specialized lenders who can evaluate these deals based on actual risk rather than standardized underwriting criteria.

We’ve built our condotel program specifically to serve mortgage brokers working with investment clients who need solutions beyond conventional lending. The flexible documentation options, competitive leverage ratios, and underwriting expertise we bring to these transactions enable deals that traditional lenders decline automatically.

Ready to expand your product knowledge and serve more investor clients? We’re building partnerships with brokers who want to differentiate themselves in competitive markets by offering solutions that mainstream lenders can’t. Whether you’re exploring condotel financing for the first time or looking to deepen your understanding of our program capabilities, our wholesale team is here to support your success. Connect with us today and discover how condotel lending can become a valuable addition to your product toolkit.